Everyone in the industry is, in our opinion, losing their mind over fee compression caused by Robo Advisors. Advisors feel they need to increase their spending on technology and cut their fee in half to prevent their clients from leaving in droves for a Robo Advisor.

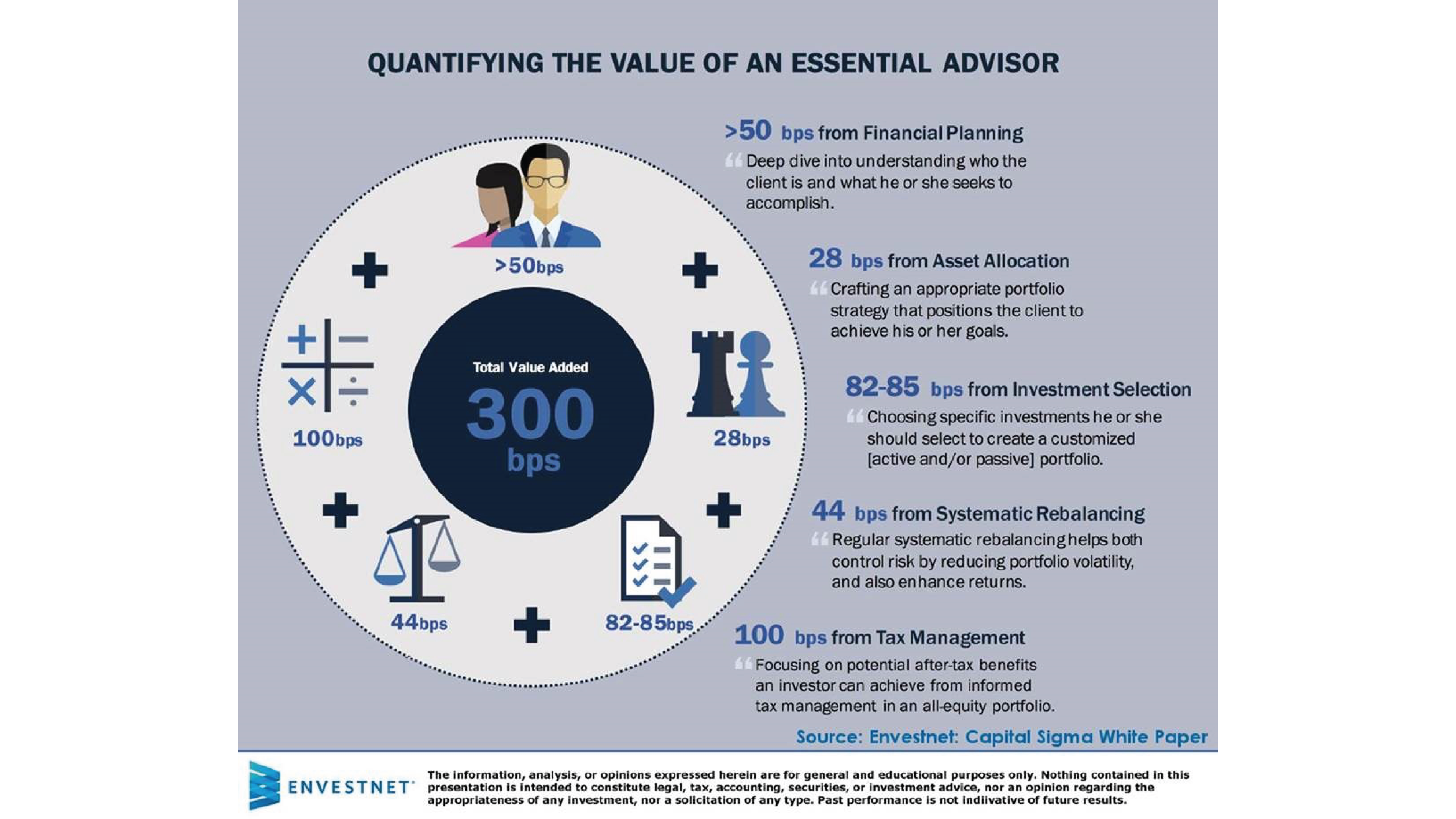

If you take a short step back, wouldn’t you agree the advisory community adds value beyond a slick user interface? Envestnet has put together a great white paper detailing the “5 Pillars of Advisor Value.” Financial Planning adds 50 bps to a client’s return. Asset Allocation adds 28 bps; Investment Selection accounts for 82 bps of return; Systematic Rebalancing adds 44 bps; and proper Tax Management can add as much as 100 bps of return. In aggregate, this adds up to over 300 bps of real value. And we haven’t even addressed the servicing of accounts advisors provide: wire transfers, systematic disbursements; bill pay; etc. We’re not recommending you increase your fees to 300 bps, but maybe you should think twice before cutting fees across the board.

View Envestnet’s White Paper Here

This analysis is based on their new book, “The Essential Advisor,” written by Bill Crager and Jay Hummel.