The most common question we receive from breakaway advisors is, “If I start an RIA, how do I recreate the products and services I’ve always had available to me during my career in the wirehouse?” This line of thinking often leads to questions around Lending and Alternative Investments, and inevitably lands at Separately Managed Accounts. A recent FundFire article noted that “Separately Managed Account (SMA) assets have rebounded far past their pre-financial crisis peak,” so it’s a safe bet that wirehouse advisors are offering these products to their clients and worry how they will best access SMAs in the RIA channel. With this article, we hope to help advisors better understand the differences between dual-contract SMAs and single-contract SMAs/Unified Managed Accounts (UMAs1) and the decision matrix associated with each.

SMAs have gained popularity with advisors and clients because they offer a convenient way for investors to own the individual underlying securities of a larger investment portfolio, unlike a mutual fund or ETF where the investor simply owns a share of an overarching fund. These types of managed accounts were designed to provide individual clients with sophisticated investment opportunities that historically were only available to larger institutions. SMAs can offer greater freedom of choice, tax and operational efficiencies, and more customized investing solutions. When determining whether dual-contract or single-contract SMAs are the better choice for RIAs and their clients to access these investments, there are a few distinguishing factors to take into consideration.

At a high level, it typically comes down to scale: Does an RIA have enough assets to allocate to a specific manager that the third-party manager will be willing to negotiate directly with the RIA? And would that firm’s client base meet the individual account minimums with each investment strategy? If the answer is “yes,” most advisors have historically elected to access the manager through a dual-contract SMA, where the client will execute an investment advisory agreement with the RIA, as well as with the investment manager. This allows the RIA to negotiate their own fees with the manager and have a direct relationship in which they can instruct the manager on tax loss harvesting and timing of trading and liquidations. If the RIA can negotiate a reasonable fee with the investment manager, this added level of oversight is often preferred.

Dual-contract SMAs also give the RIA absolute control over the research, due diligence, and hiring process. RIAs can choose to meet with various managers and discuss in detail the available strategies each manager offers. While the hiring and firing process can come with some additional paperwork, the RIAs engaging in dual-contract SMAs typically have the bandwidth to handle this. Each new relationship the RIA establishes represents a new opportunity for the advisor to further tailor their own curated list of managers and investment strategies to meet their clients’ needs with complete autonomy.

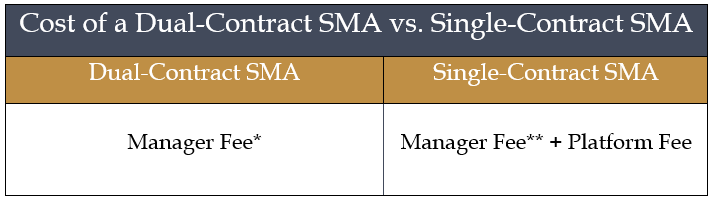

If the RIA is only allocating a small amount of assets to a particular manager/strategy, or if the underlying clients cannot meet the individual account minimums, single-contract SMAs/UMAs may be the best way to access the portfolio. Here, the client signs a single investment advisory agreement with the RIA, who invests client assets in managed accounts through an SMA platform provider (Envestnet, SEI, AssetMark, Brinker Capital, FTJ FundChoice, etc.). The SMA platform provider, having a direct relationship with third party managers, performs all tax loss harvesting, trading, and liquidations. The RIA also relies on the SMA platform provider’s collective buying power with the manager. The platform provider will have negotiated the fee directly with the manager, and the RIA can access strategies at the agreed-upon Manager Fee thanks to the scale secured by the provider. On top of the discounted Manager Fee, RIAs must also consider the Platform Fee charged by the provider. For smaller asset allocations, these two fees combined should still be a cost-effective option. For larger asset allocations, it may be worth doing a bit of research before determining whether single-contract or dual-contract SMAs offer more competitive pricing (see visual below).

Sean Mullen of AdvicePeriod, who has experience in both dual-contract and single-contract environments, points out that regardless of an RIA’s size and investment allocation to a particular manager, single-contract SMAs offer benefits to both advisors and clients that should be considered. Sean states, “With single-contract SMAs/UMAs, all investment managers are placed into one custodial account number and the RIA’s reporting and trading software allows each manager to act independently from one another through various sleeves of the portfolio. Firing one manager and hiring another within the same account is as simple as a few clicks on the platform provider’s interface. In addition, by hiring the platform provider, one custodial account number is granting the client access to potentially thousands of SMA portfolios and strategies with lower account minimums, and the platform provider will handle trading for all these strategies. This process, defined by automation and ease, allows advisors to offer a broader array of investment opportunities to more of their clients.”

A major attraction to SMAs is the ability to capture tax losses within the portfolio. The process around tax-loss harvesting, however, varies between dual-contract and single-contract SMAs. If advisors leveraging dual-contract SMAs fire one manager to hire another, the managers within the client account are unaware of each other and it is possible that the new manager will purchase the exact security(ies) that the old manager just sold, thus creating a wash sale and negating the tax loss. In contrast, with single-contract SMAs, the platform provider is able to flag all securities that were sold by the previous manager, so the new manager will be restricted from making similar purchases until the wash sale period has expired. Depending on a firm’s size and ability to scale, this may be a serious consideration for RIAs contemplating dual-contract SMAs vs. single-contract SMAs.

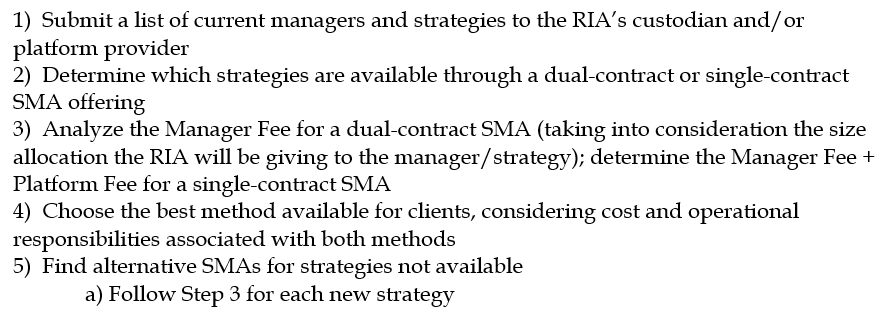

Taking all of the above information into consideration, the process of recreating SMA portfolios for advisors looking to transition from a wirehouse into the RIA space can be broken into 5 steps:

Recreating Separately Managed Accounts within the RIA industry is a process that is manageable, thanks to dedicated resources with the custodians, platform providers, and consultants available to advisors seeking additional guidance. Advisors should allocate enough time to analyze whether dual-contract SMAs or single-contract SMAs best fit their business, and ultimately, best fit their clients. Larger RIAs that have enough negotiating power on their own may benefit most from dual-contract SMAs, assuming they have the scale to manage the required oversight. Single-contract SMAs provide an attractive alternative to those that either lack scale or wish to capture some of the operating efficiencies that SMA platform providers deliver. Either solution affords advisors confidence that the RIA space is one of diversity and sophistication in which, with a little research, the best investment option is available for their clients and their firm.

1Recently, SMAs have evolved even further into Unified Managed Accounts (UMAs), a collection of single-contract SMAs under one account number. While some SMA platform providers differentiate between single-contract SMAs and UMAs, for the purpose of this article, we refer to them synonymously.