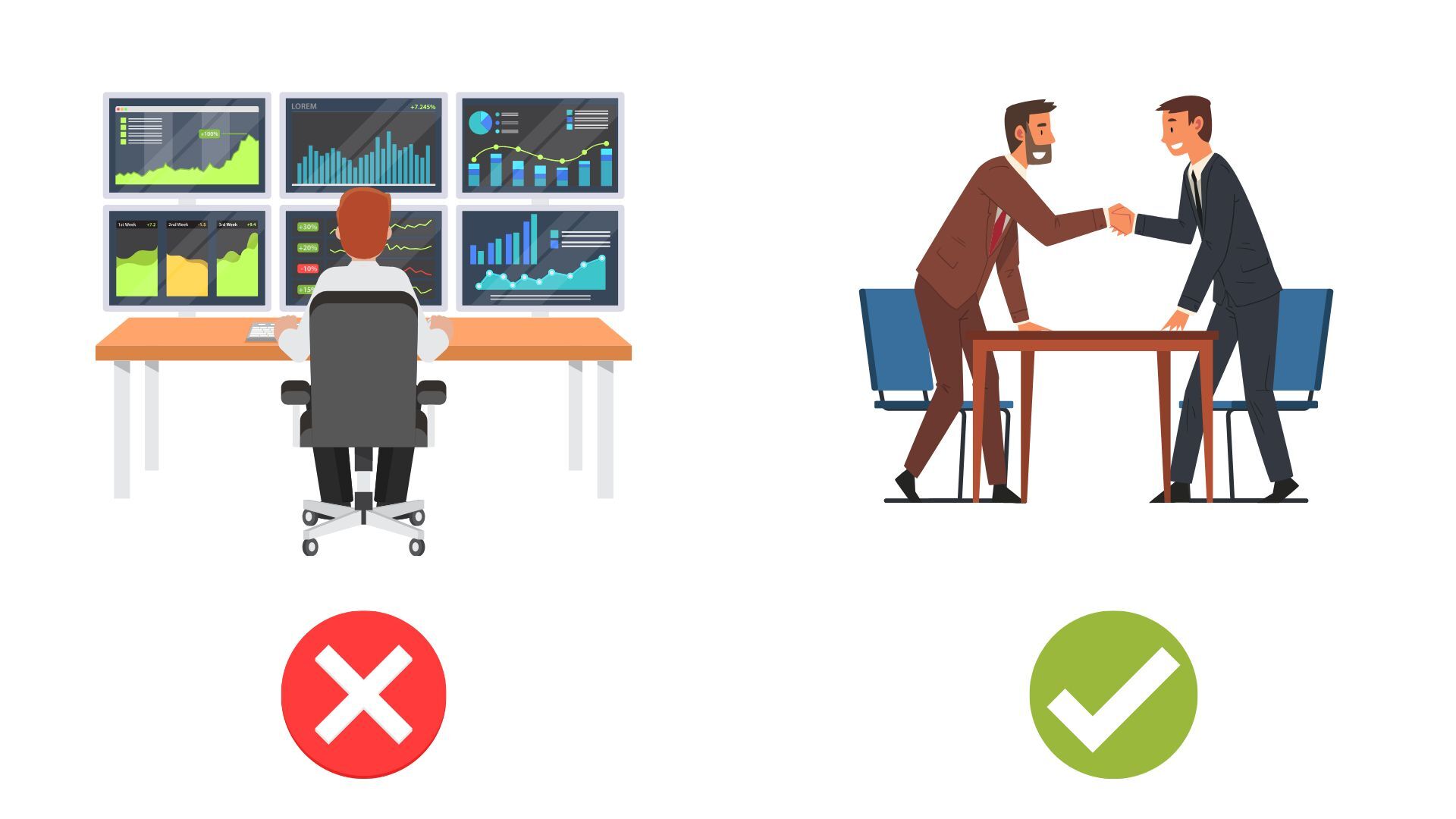

As an RIA grows and more and more specialized roles begin to take shape across the organizational chart, advisors will gladly hand over the burdens associated with tasks such as employee onboarding, or Compliance, or the intricacies of reporting on outside assets. But one area they seem to get stuck on is Trading. We’ll save the argument of whether or not financial advisors should spend their time and energy on investment decisions and security selection for another day, but when it comes to RIA efficiencies around Trading, I’m passionate about promoting the idea that advisors should not enter trades. Amazingly, I’ve actually gotten into arguments with advisors about this as they’ve tried to tell me, “My clients trust me, they’ve hired me to do their trades for them – I have to be the one that types out on my keyboard, ‘Buy 50 shares of AAPL,’ ‘Sell 90 shares of IBM.’” I confidently disagree with this notion.

Clients hire an advisor to act as a guide through the dizzying arena of economics and investments. Can the advisor help them understand which financial headlines are important, and which headlines are merely noise? How can a husband and wife ensure that they are on track for their three largest goals: saving for retirement, sending the kids to college, and fulfilling their philanthropic commitments? Who, other than a competent financial advisor, can assist that husband and wife in prioritizing those financial goals and evaluate the various tradeoffs they will have to make to achieve them? These are the things clients value from their advisor – not the advisor’s data entry ability.

When an advisor receives a request from a client to raise $20,000 in the portfolio, they should simply pass that information to someone else at the firm that can go in and rebalance the portfolio. The advisor themselves should not pull up an Excel spreadsheet and manually input the value of each position in the portfolio, compare it to a model, and then calculate which positions they will raise cash from. The advisor should simply notify someone on the team that, “Johnson needs $20,000” or “Smith deposited $100,000 – go ahead and invest that.”

Data entry should not be part of the advisor’s job description. And whoever is in charge of entering these trades at the firm should utilize a drift report inside the trading software to automate this process – there is no reason firms should be using Excel as their primary trading tool. Manual entry itself leads to too many trade errors.

The only way an advisor can say, “I have to be the one to enter these trades – no one else here at the firm can do it but me,” is if each portfolio is completely customized and no one at the RIA understands the asset allocation for the particular client. This is a major problem in and of itself, and something that needs to be rectified immediately if that is how the firm functions.

The use of model portfolios is a huge efficiency booster for RIAs, where you take a client’s risk tolerance and time horizon and drop them into one of five or six model portfolios managed by the firm. This is where trading software can drastically increase the efficiency of your firm and limit trade errors.

But even if a firm says, “We are more customized than that, each client’s asset allocation is specific to them,” it doesn’t mean trading software cannot support this approach. While not as efficient, you can create a model for each client inside the trading software. If Mr. Lee calls and wants money raised from his accounts, the advisor can direct someone to run a drift report of Mr. Lee’s portfolio against the specific Lee model inside the trading software, and with a click of a button, Mr. Lee’s portfolio can be rebalanced. There is nothing inside the trading software forcing Mr. Lee to have the same asset allocation as 25 or 30 other clients…but by having his model inputted into the software, anyone at the firm can rebalance his portfolio with just a few clicks.

If you are interested in Trading efficiencies, you must remove advisors from a hands-on method and instead relegate their role to sending trade instructions to their client service team. Additionally, you must automate the data entry process – too many RIAs are still conducting their trading via Excel spreadsheets. Finally, without assigning clients to models, whether those are broad-based models used across the entire client base, or models specific to each client, your firm will never reach economies of scale. Makes these three changes and you will free up Advisors from focusing on data entry and allow them to do what they do best: bring in new assets by developing new and managing existing relationships.