We are often contacted by RIAs that ask us to perform an assessment of their technology, their processes, and their people. Typically, we’ll start that analysis by asking the firm’s owners to pretend we are a prospective client and give us their value proposition pitch. We want to hear firsthand what promises are being made to prospective clients — why they should work with the particular RIA — and then, as we dig into how they deliver their services to clients, we look for mismatches between those promises and the actual client experience.

The area we see the greatest mismatch between the promises and the reality is right at the outset of the relationship – specifically, during the client onboarding process. And that is tragic, really, because this is the client’s very first impression of your firm after they have said, “Yes, we’d like to work with you!” It is a serious problem when RIAs deliver a clunky and frankly, an embarrassing client experience during the onboarding of new clients.

To illustrate further, here’s a scenario we typically see:

An advisor has spent months, if not years, prospecting a particular client. They’ve had tremendous follow up during this dating phase, getting to know the client and their family; the financial goals of the various family members; what keeps them up at night with respect to their finances; etc. Finally, the prospect says, “Yes, let’s move forward!” and the advisor is so excited, and so worried that the prospect may change their mind, that the advisor simply says, “Thank you!” and they hightail it out of the meeting. They don’t want to say anything further that could potentially upset the prospect or cause them to rethink their decision.

Then the advisor gets back to their office, very proud of themself, and they tell their staff, “Mr. Jones is in!” And the staff just stares blankly at the advisor, hoping for more information. They ask, “How many accounts are we opening?” “What type of accounts?” “Where are the assets coming from?” Then, in a last-ditch effort to gather any bit of information on the new household, the staff asks, “Well, did you at least get statements, so we can try to figure out the information needed to open these accounts?” And the advisor simply says, “I didn’t want to bog the client down with silly details – just make sure the accounts are opened and the assets are transferred by the end of the week!”

After explaining to the advisor that they simply can’t open these accounts without some level of information, the advisor says, “OK, just write down all the questions I need to ask, and I’ll call the client…” But not knowing the types of accounts being opened makes it very difficult for the staff to know what questions to ask. As more information is uncovered regarding the nuances of the family and the particular accounts being opened, more questions will arise. “Oh, we didn’t know it was a deceased IRA, we need more information,” or, “One of the trustees on this account lives overseas? There’s a few more questions we need to ask…” This additional needed information results in the advisor calling the client multiple times, each time assuring the client that they now have all the necessary information to transfer the accounts, only to have another call to the client to gather further information. By the third or fourth call, the client starts to wonder, “Does this firm really know what they are doing?”

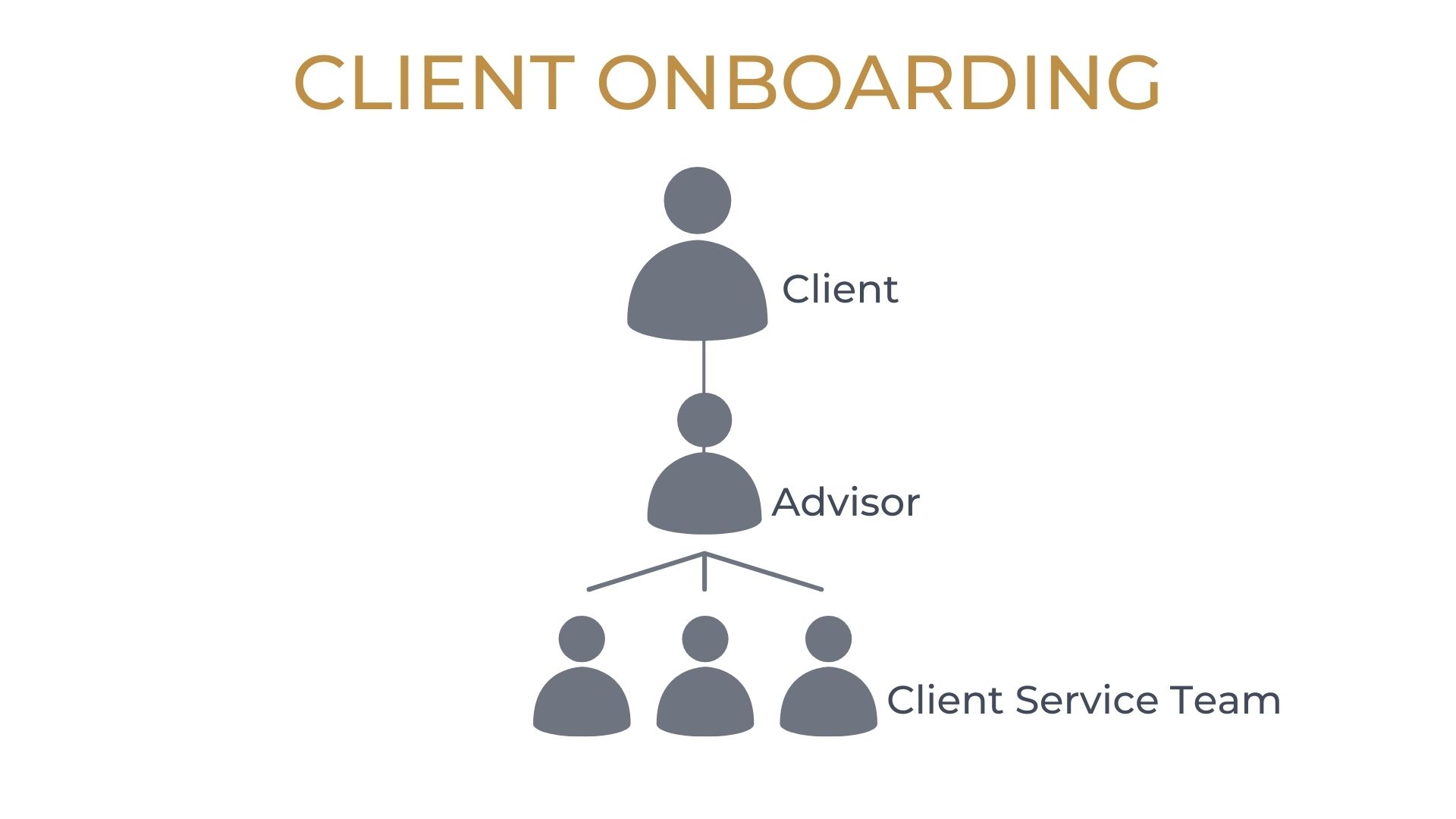

We typically solve this client onboarding conundrum in one of two ways. We may advise our RIA clients to simply take the advisor out of the process all together. When a prospective client finally says the magic words, “We’re ready to move forward with you – how do we get started?” the only acceptable response from the advisor should be, “I’ll have my staff contact you!” The staff has been trained on all the nuances of every possible account scenario and will know exactly what questions to ask of the client.

Many advisors will balk at this suggestion and say, “This relationship is still new – I have to be the one to gather all of this information…they trust me!” but we always remind them that as soon as the assets have arrived and the portfolios have been built, the client will be interacting with the staff more often than they will interact with the advisor, so you might as well get the client introduced to the staff sooner than later. You’re only going to diminish that trust you’ve built so far with the prospective client if you must go back to the client 11 times to gather all of the necessary account information – let the staff dazzle the new client by doing the job they are trained to do!

If an advisor really digs their heels in and refuses to step out of the data gathering process, the second way we look to solve this problem is to recommend the staff send an email to the prospective client the night before the meeting stating, “Dave is really excited to meet with you tomorrow! Should you choose to move forward, this is the type of information we’ll need to gather from you: statements on all accounts you wish to transfer; DOBs and SSNs on all owners of all accounts, as well as any beneficiaries to any retirement accounts; full name and date of any trust accounts; articles of incorporation or operating agreement, along with proof of state filing for any corporations or LLCs you wish to transfer; etc.”

This way, when the advisor invariably forgets to ask for all the necessary information, the client can say, “Dave – your staff said you would need this…I put this together for you this morning.” It’s tough to ask every possible question in this preemptive email when the staff doesn’t yet know exactly what types of accounts they are dealing with, but at least the advisor will return from the meeting with enough information to get the process started, which is better than before when they showed up with absolutely nothing!

For advisors looking to grow their business through client referrals, the client onboarding process is critical in delivering a “Wow!” experience. Involving the staff as early as possible ensures that the proper questions will be asked, the necessary information will be gathered, and the new client will be impressed to the point of becoming a raving fan for the RIA. Advisors have many admirable traits – they maintain their positivity despite dealing with rejection on a regular basis; they have the innate ability to build rapport with strangers, ultimately earning their trust and respect; and most advisors in our industry truly put the clients’ interest ahead of their own. However, when it comes to paperwork and various account types, one thing advisors are not, is detail oriented. Show your new clients the depth and specialization of your team right from the start of their official client experience, and wow them with a smooth and seamless onboarding — because remember, you can never make a second first impression.