In our work with new and established RIAs looking to build and/or improve their technology stack, we encounter many frustrated advisors who lament, “We were told that the benefit of being an RIA was that all of our technology systems would be integratable with one another – while that may be the case for other RIAs, none of our systems talk to each other.” We always smile and say, “Integration among your various back office systems is definitely achievable, but it takes a lot of planning and execution to get there, and not all integrations are created equal.”

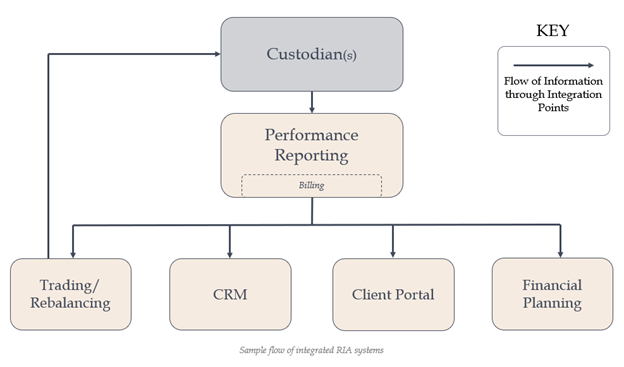

In an ideal world, data will flow seamlessly from an RIA’s custodian into the firm’s reporting provider, and from there, data will be routed into the other core systems (CRM, Trading, Financial Planning, etc.). An example of a proper data flow would be after calculating and creating trade files within the trading/rebalancing software, those trade files should automatically be transmitted to the proper custodians through a FIX connection. In another example, with a truly integrated environment, a client’s address change should only need to be inputted into one system, and then automatically populated in all others.

Where advisors run into trouble is assuming that every reporting provider offers deep integration with every CRM on the market. Or that every trading tool integrates seamlessly with any reporting provider of the advisor’s choosing. This simply is not the case.

Advisors looking to build an efficient technology stack must make one decision, selecting one strategic system choice at a time, always considering which systems offer true bidirectional integrations with the most recent system they chose to implement in the stack. Keep in mind, there are one-size-fits-all, pre-integrated platforms on the market, but for advisors who want to choose best of breed systems in every corner of their tech stack, they will be forced to play this technology version of 3D chess, where each choice will need to be made based on the system chosen before and chosen after it. There are many third party operations and technology consultants (PFI Advisors being one of them) that can guide advisors through this decision making process, but detail-oriented advisors can also work closely with the various technology vendors to determine their integration points with other leading technology tools supporting the RIA industry. While it can be a slow and arduous process to achieve a fully-integrated back office, we believe integration provides both economic and operational benefits to RIAs willing to undergo some short-term pain.

A fully integrated back office will save employees time, which will allow them to service a larger pool of clients. As the firm grows its assets under management, a streamlined operational infrastructure will allow that additional revenue to ultimately hit the bottom-line profitability of the firm. Higher cash flows mean larger multiples, should the firm look to monetize in the future. And if the RIA wants to attract other advisors to join their organization, an efficient, scalable, and integrated technology stack will be the biggest component of the firm’s advisor pitch.

Integrating the various tools that make up an RIA’s technology infrastructure is not easy. It definitely cannot be achieved in the blink of an eye. But there are countless reasons to tackle the challenge. RIAs must start with integratable systems, then apply their own blood, sweat, and tears to make them integrated.