Members of The COO Society often hear me say, “Choosing technology tools for your RIA is relatively easy (there aren’t that many technology tools to choose from!) but building processes around those tech tools is the hard part!” But that’s not to say that plenty of firms don’t struggle when choosing technology. Having a clear understanding of your ideal client and knowing exactly what services you want to deliver to that client will make your tech choices easier, but that still won’t solve for one very common problem we repeatedly encounter: analysis paralysis.

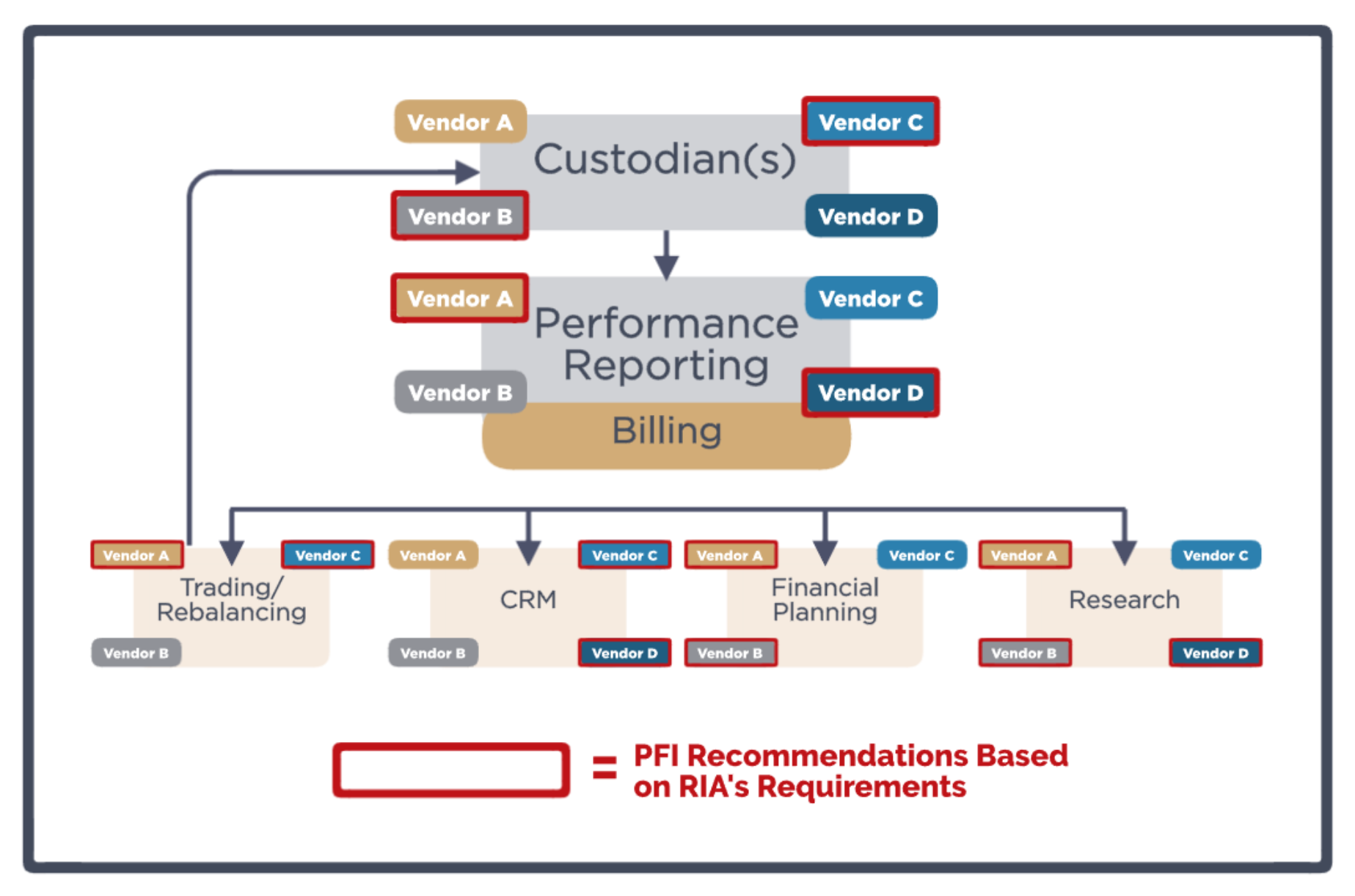

Based on an RIA’s specific client base and the products and services the RIA wants to deliver, we try to narrow the number of tech vendors evaluated to no more than two or three per component of the back office, so as not to overwhelm the decision makers.

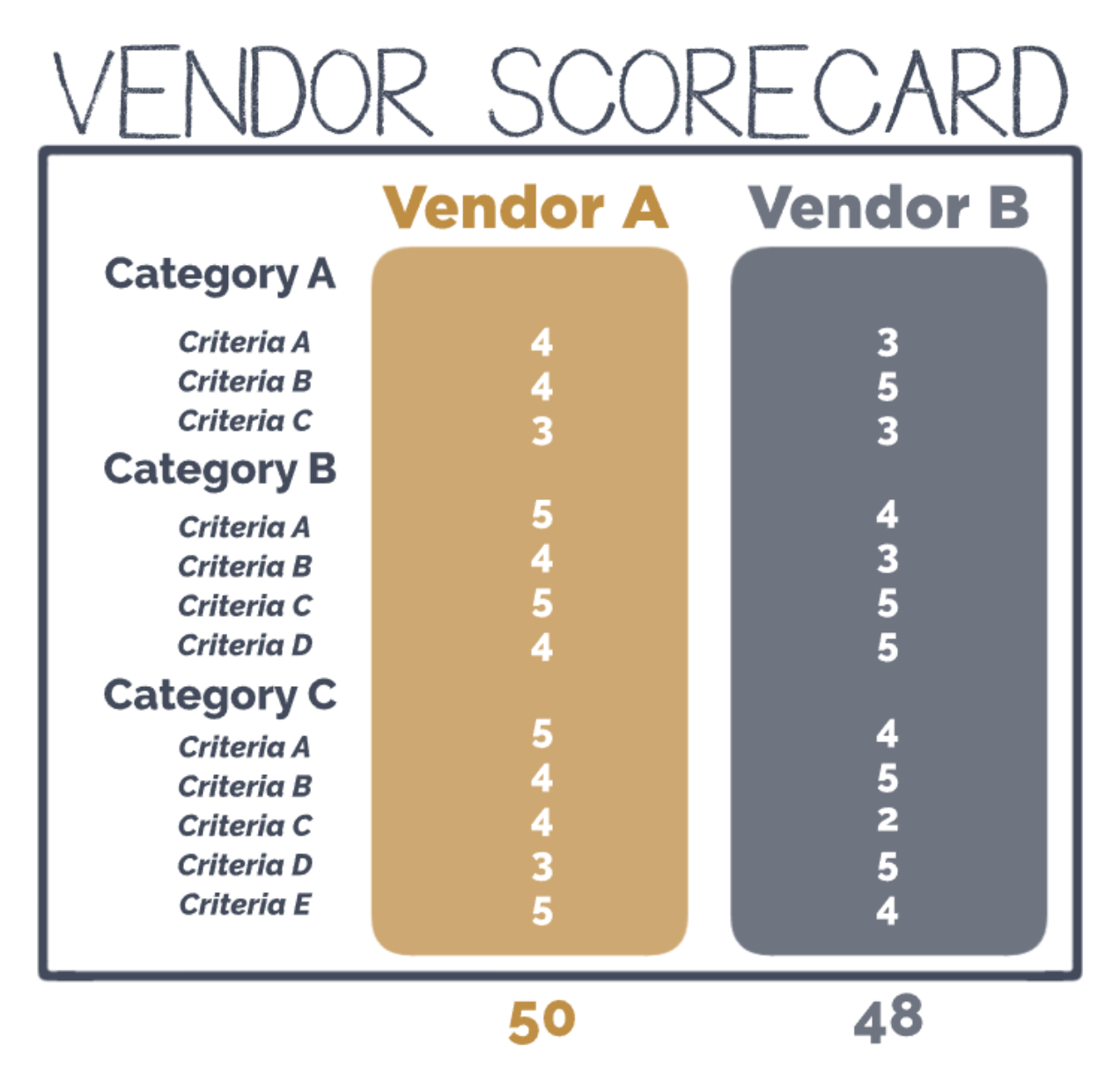

Next, we’ll set up demos and calls with the various technology vendors to ask questions and ultimately fill out a Vendor Scorecard: a side-by-side analysis that ranks each vendor based on specific criteria deemed important to the RIA.

After various demos and requests for further information from each vendor, along with several client reference checks, we’re confident our client is in good shape to make a decision. But inevitably, some RIAs at this point will declare, “We need more information – we just feel we don’t have enough data to decide yet. Let’s do a few more reference checks.” To accommodate our client, we’ll set up a few more reference calls or even a repeat demo, but the RIA typically doesn’t learn anything of material significance during these additional calls. There is no new information that radically changes the scorecard or makes the decision any more obvious. The same pros and cons discovered in the initial due diligence process remain. By this time, something usually “comes up” that distracts the decision makers even further. “We have a few people out on vacation – let’s regroup in a few weeks.” “It’s quarterly billing time, let us focus on that for now, we’ll circle back to this once billing is finished.”

With the growth our industry has experienced over the past few years, it’s no surprise that RIA professionals are busy servicing client relationships, but in our experience, the “busyness” that inevitably creeps up right around decision-making time has little to do with the items on their To Do List and has everything to do with the fear of failure:

“What if, after making this decision and putting the firm through a long implementation process, this software doesn’t really solve our problem?”

“I really like Vendor A, but our CEO has a friend who runs an RIA, and they use Vendor C – will I look stupid if we go with Vendor A and things don’t work out?”

“You know, we’re getting by just fine, maybe we shouldn’t rock the boat and attempt a software conversion right now…”

The weeks and months an RIA spends overthinking a decision is time they will never get back. Time spent on calls, gathering information, doing further research, updating their teams about a potential solution, is very important…but only if it leads to a decision. The tech choice needs to be made so that the firm can move to the next important step: implementation.

Successfully leading an organization through a change can be a daunting task. As Matt Reiner recently wrote in Wealthmanagement.com, “As the desired changes and the potential impact on your organization grow, so too does the difficulty in implementing them in a meaningful, lasting way.” He pointed to a research study that showed “two out of three transformation initiatives fail.” We strongly believe those failures aren’t caused by poor technology choices, but due to poor processes built around those chosen technology solutions. RIAs should choose the technology relatively quickly then spend most of their time and energy solving how the firm will leverage the technology to reach their goals.

And those processes typically can’t be built until the technology is chosen. Your billing process will be slightly different based on which tool you are leveraging for billing. Your financial planning process will be different with Vendor A vs. Vendor D. The firm’s performance reporting process will be different depending on which performance reporting tool your firm has chosen. That’s why it is critical to get the software chosen as quickly as possible, so the real work can begin.

As Don Connelly recently wrote, “For many people, getting ready to get ready is less about getting everything perfect and more about delaying the inevitable. We can look busy, even productive, getting ready, but what we are really doing is hiding in the distractions that keep us from doing what we should be doing.” And if you have been tasked with building a tech stack that supports your firm’s growth, what you should be doing is choosing leading software solutions (again, there aren’t that many to choose from in the RIA industry) and then building processes around those technology tools. As Mr. Connelly stated in his article, “Very often, the sheer dread of doing a task (in this case, making a decision) is more stressful than performing the task itself.” So, perform your due diligence and make that technology decision today!