Anders Jones of Facet Wealth recently wrote that as RIAs approach the elusive $1 billion AUM milestone, they need to be increasingly cognizant of their profit margins and resources needed to service their clients. The goal of any RIA is to provide high-touch service to an ever-expanding client base. RIA owners will achieve this goal by properly executing their business plan with the help of people, processes, and technology. As operations and technology consultants, it is our job to help business owners properly allocate their finite resources for more efficient growth. Said differently, through proper processes, how can the firm best allocate their people and technology across their client base? This question cannot be answered without first conducting a proper client segmentation exercise.

Client segmentation can be approached very quantitatively, where team members are asked to track hours (or quarter hours) spent on each client over a week or month timeframe, and then rate every client on a revenue generated divided by time basis. Or, you can take a bit more qualitative approach and simply sit down with your team and ask them to rank every client on a scale of 1 to 5; 1 being a client that rarely calls, and 5 being a client that calls the office multiple times a week with money movement needs and other varying service requests.

Once the clients are ranked, you can look for discrepancies. For example, are there some clients ranked at a 5 that aren’t generating much revenue for your business? If so, a conversation with your client may be in order. You don’t necessarily need to cut ties with them, but a discussion around fees and/or the amount of time you are able to dedicate to the client would be prudent. Be sure to consider some non-monetary considerations when determining the proper fee associated with a particular client:

- Do they have assets elsewhere that they could potentially transfer to you?

- Are they likely to come into more money through the sale of a business or an inheritance?

- Are they worth the extra time and resources because they have proven to be a fantastic referral source?

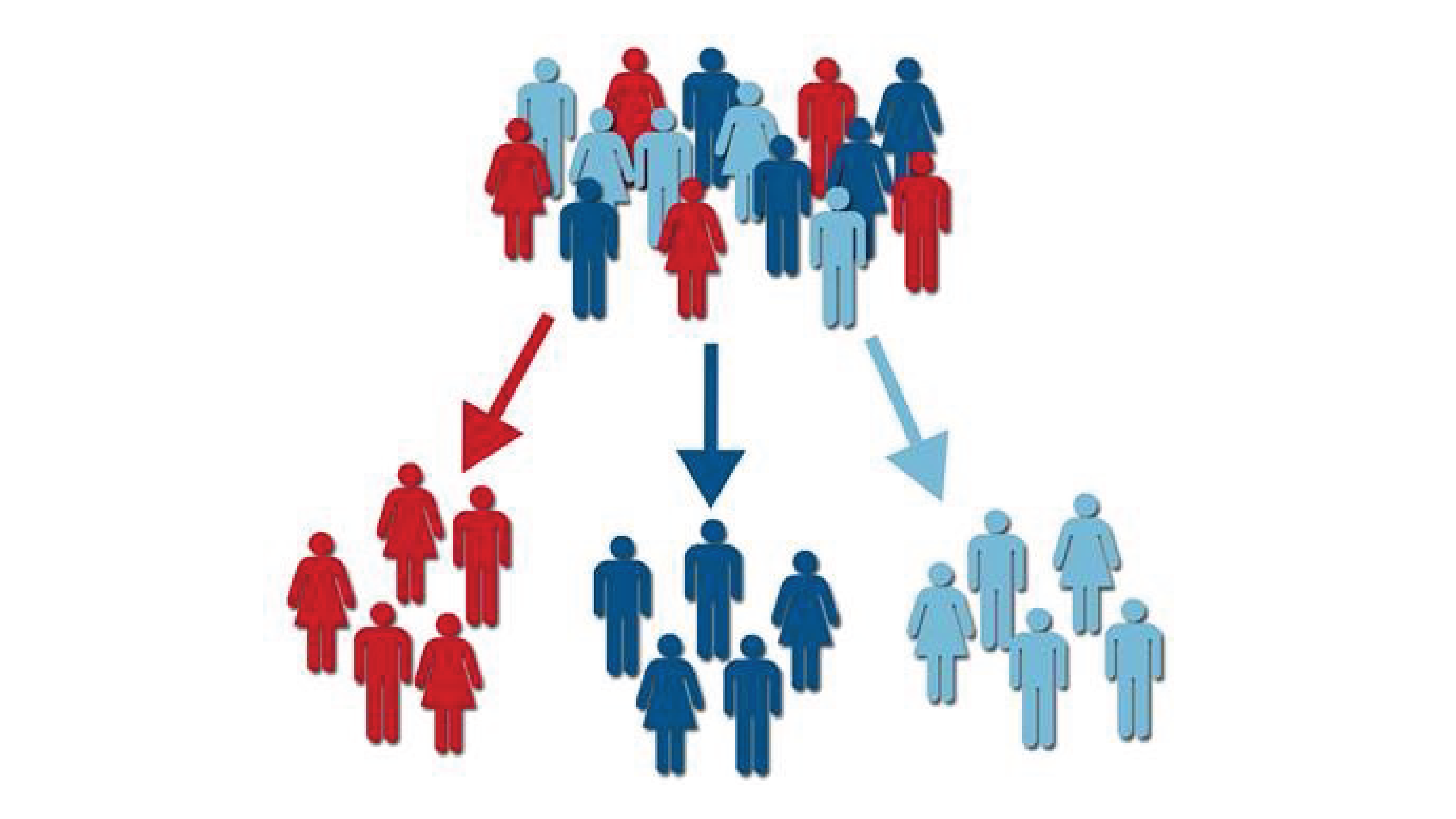

Now, let’s take it one step further. Once each client is ranked on a scale of 1 to 5, or however you choose to rank them, have an objective way of tagging your clients and categorizing them into Platinum, Diamond, and Gold tiers (or whatever labels you choose). A client’s placement into one of these three categories would not only be based on their ranking 1 to 5 but also their potential to provide referrals and/or new assets. For example, if a client is ranked as a 1 because they rarely call but they are an executive at a company that is about to go public and have sent a number of quality referrals, they should be a Platinum tier client. Based on the tiers you assign your clients, determine the appropriate levels of service:

- How often do you speak with the client?

- When you speak with them, is it in person? Do you meet at their office or home, or do they come to you?

- How many hours of your staff’s time do you allocate to these clients, based on their tier?

- Do you include some of your concierge services as part of the client’s overall AUM fee, or do you need to charge extra for certain services provided to some clients? Some examples might include:

- Tax prep

- Bill pay

- Liquidity management

- Review and tracking of outside investments

- Trust/Foundation administration

- Estate management

As Anders concluded in his article, by focusing your efforts on profitable clients, you ensure your RIA can support the infrastructure needed to sustain its’s success, which he defines as, “…increased headcount, scalable technology, a robust investment platform, and solutions for the burgeoning middle and back office needs that would otherwise drag advisors away from what they do best.” While many industry pundits categorize client segmentation exercises as a marketing responsibility, we believe they can play a critical role in helping firms properly allocate resources as they attempt to grow and scale their businesses.