M&A

BLOG POSTS PUBLISHED SINCE INCEPTION

Integration Or Indigestion? Making It Work After The Deal Closes

M&A provides many benefits to the wealth management space. It assists firms in gaining access to technology and other support that saves advisors time, streamlines their work, and improves...

Get Your Organic Growth Process In Order Before Pursuing M&A

The registered investment advisor industry continues to report declining organic growth numbers, with many firms struggling to see gains above that of the stock market. With the allure of an...

Common Drivers of M&A Activity

From a Buyer’s Perspective

The current state of RIA M&A activity seems to be a hot topic in the press these days. While rising interest rates and a slowing stock market are sure to dampen the record-breaking pace of...

The Important Role Talent

Plays in M&A Transactions

For buyers and sellers, highlighting the talent up and down the organization is a powerful way to stand out among competitors. It has been widely reported that 2021 marked the eight consecutive...

Buyers, Sellers Must Determine

“Who’s Steering the Ship?”

Like with any relationship, it’s important to have those uncomfortable conversations early. We have previously written about the trials and tribulations of RIAs looking to merge businesses in the...

M&A Requires More Than

Securing Financing

What first-time buyers are missing is that, despite popular opinion, most transactions are not propelled solely by a seller’s desire for monetary gain – they simply want to feel that by joining a...

Top 5 Mistakes Buyers Make

When Integrating Acquisitions

These are the ways buyers and sellers commonly fall short when combining firms. 2020 was another banner year for M&A activity in the RIA industry, and while deal makers continue to build on the...

Making a Big Firm

Feel Small

The continued tear of M&A activity throughout the RIA industry has resulted in some firms reaching critical mass very quickly. These firms are learning that with size comes all the...

Investment Philosophy Kills More

M&A Deals Than Valuation

If the collective vision for investment philosophy—who will be managing the portfolios and choosing what the best investments are for client portfolios—cannot be agreed upon, there is no reason to...

Thinking of Selling? Focus on

Profits Before Hiring a Banker…

With RIA M&A activity at a frenzied pace, much has been written about how to best value an RIA business. Typically, a multiple is applied to either revenue or cash flow (profits). In...

Merging? Employee Communication

Is More Critical Than Ever

As we have written in the past, M&A transactions can cause a tremendous amount of trepidation and angst among employees of both Buyer and Seller. While completely normal, the root of fear...

Post-Merger Integration:

“Yes” is Nothing Without “How”

In his book on negotiation, “Never Split the Difference,” former FBI hostage negotiator Chris Voss states that, “’Yes’ is nothing without ‘How.’” Voss, who made a living brokering some of the...

The Fear of Change, Part 1:

The Emotions of an M&A Transaction

The Fear of Change: A 3-Part Series for RIAs As the RIA industry matures, consolidates, grows, and evolves, many of our clients contemplate M&A transactions, changing their technologies or...

Two Key Ingredients to

a Proper M&A Strategy

Not a day goes by that the RIA press isn’t reporting on another merger or acquisition. At industry conferences, the panels discussing M&A are the most highly attended. With more and...

Book Review: The Financial Advisor M&A Guidebook

PFI Advisors has written a lot around the operational side of M&A, and how important it is for firms to think through not only deal structure and valuation, but the planning process around...

5 Building Blocks to Becoming a Successful Buyer

There are more than 12,000 SEC-registered investment advisors[1] in the United States trying to differentiate and grow their businesses across the competitive and fragmented RIA space – a...

5 Building Blocks to Branding Yourself a Successful Buyer

As we announce our latest co-written white paper, we thought we would first share some background research and history put into this particular M&A thought leadership piece. While this is...

“M&A Through the

Operational Lens”

We have been long-time proponents of the notion that RIAs need top tier technology infrastructure to support growth through M&A. Many would-be Buyers mistakenly think…

Harnessing RIA M&A strategies for growth

With the RIA industry setting itself up for further consolidation based on the macro trends impacting the industry, the opportunity for peer-to-peer M&A activity is increasing dramatically....

Jumping into

the M&A Game

As operational and technology consultants, we are contacted at least three times per month from larger RIAs saying, “A friend of mine just bought a $100 million practice – I want to do that too!”...

7 Critical Steps to Becoming a Professional RIA Buyer

As conference season winds down in the wealth management industry, everyone seems to be discussing the “mega trends” that are leading to consolidation in the RIA space. From aging advisors, to...

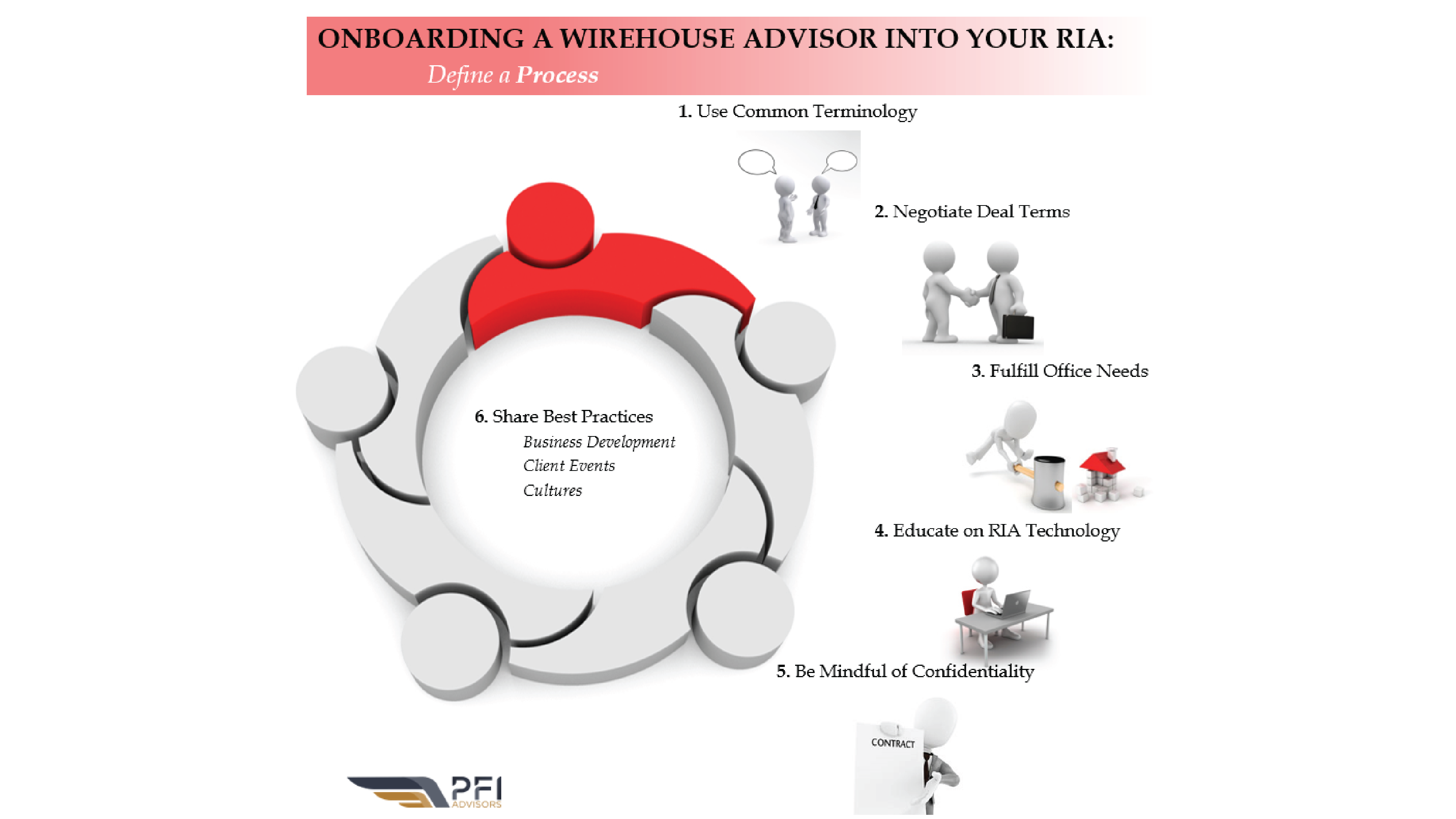

Onboarding a Wirehouse Advisor Into Your RIA

For an RIA, onboarding a wirehouse advisor or advisory team and incorporating them into your firm is an intriguing concept, but seems daunting to most. The biggest question RIAs always have...

Solving Operational Issues from M&A Transactions

As the wealth management industry continues to age, the number of advisory firms that will be transitioned due to succession planning or principal retirement is expected to increase dramatically. In...